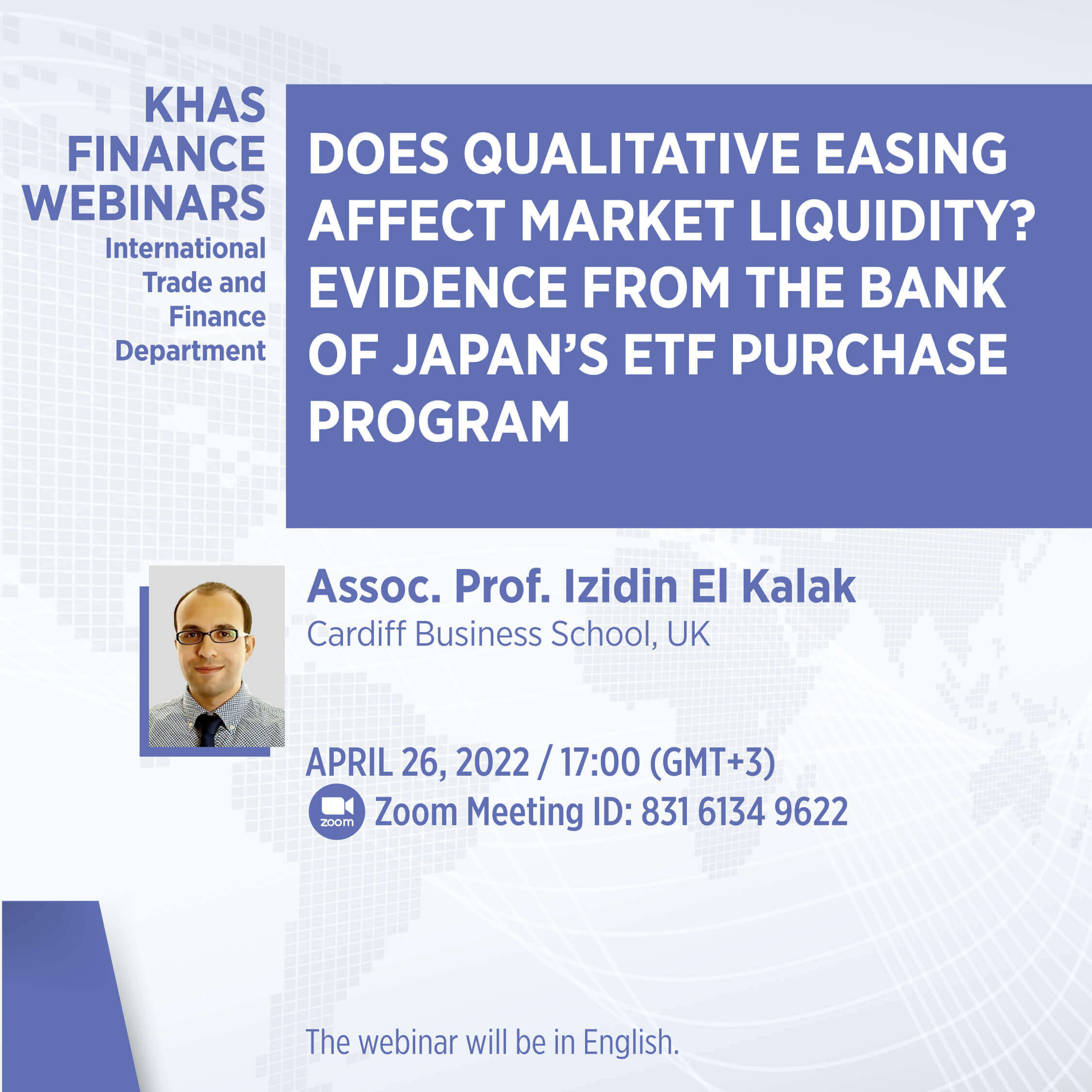

KHAS Finance Webinars – Assoc. Prof. Izidin El Kalak

The guest of the Finance Webinars series organized by Kadir Has University International Trade and Finance Department is Assoc. Prof. Izidin El Kalak (Cardiff Business School, UK) on Tuesday, April 26.

You may follow Dr. Kalak’s speech titled “Does qualitative easing affect market liquidity? Evidence from the Bank of Japan’s ETF purchase program” on Zoom at 17.00 (GMT+3).

The webinar will be in English.

Zoom Meeting ID: 831 6134 9622

Zoom Linki: https://us02web.zoom.us/j/83161349622

Abstract: Using the Bank of Japan (BOJ)’s large-scale index-linked exchange-traded funds (ETFs) purchase program, this paper examines whether quantitative easing affects market liquidity of the underlying assets. Using a large sample of Japanese stocks, we document that stock liquidity significantly decreases when a firm’s ownership by the BOJ increases. Increased ETF arbitrage activities significantly and partially mediate such effect. The commonality in liquidity across stocks and pricing inefficiency also increases with BOJ ownership.

About the speaker: Izidin El Kalak is an Associate Professor in Finance at Cardiff Business School. Prior to joining Cardiff University, he worked at Kent Business School, UK. He holds a PhD in Finance from Hull Business School, UK (2016). He also received an MSc degree (with Distinction) in Financial Management (2011) and a BSc in Economics (2007). His main research interests are in the areas of empirical corporate finance, governance, managerial behaviour, and renewable energy investments. He has published in journals such as European Financial Management, Energy Economics, Journal of Economic Behavior and Organization, Review of Quantitative Finance and Accounting, International Review of Financial Analysis, among others.